Introduction

The import of goods and services is an activity that is recorded daily in countries around the world, it is generally a transfer or commercial exchange between the seller and the buyer but because there are many factors that influence directly or indirectly in these transactions, incoterms were established which are the commercial terms that are responsible for determining the responsibilities and costs to be assumed by both the seller in this case the exporter and the buyer in this case is the importer. In this article we will briefly talk about the two most used incoterms at international level (EXW and FOB), the main idea is to make the reader understand the incoterms that best suits him when making a purchase of synthetic rattan as well as the obligations and costs to be assumed throughout the import process, we will also talk about some aspects to be taken into account during customs clearance in the importer’s country.

The selection of the incoterms is determined by your needs.

Incoterms provide a clearly defined set of rules for all parties. If an Incoterm is agreed when goods are sold, it defines the rights and obligations of the parties in relation to the cost and risk of shipping. For example, under the EXW (Ex Works) Incoterm, the seller may not increase the price to cover shipping costs. These rules help the parties to avoid disagreements and ensure that all parties fulfill their obligations. It is extremely important that both parties are aware of the application of Incoterms and apply them correctly. It is therefore advisable to discuss them when concluding a contract and to put everything in writing. It is also useful to consult an international trade expert to ensure that all relevant information is included. When choosing the appropriate Incoterm, it is also important to consider the costs that may be incurred by the seller or the buyer. For example, some Incoterms require the buyer to pay shipping and transport costs; however, others allow the seller or buyer to pay these costs themselves. It is therefore important to understand the cost benefits that can be derived from choosing the right Incoterms.

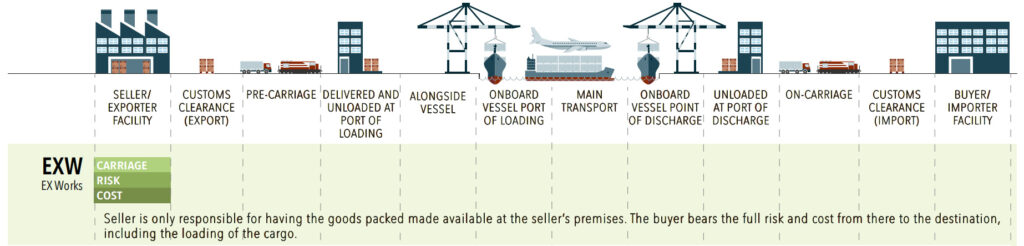

- Incoterms EXW

An EXWorks Incoterm is an agreement that maximises the buyer’s risk and liability by requiring the seller to only make the goods available to the buyer at his warehouse or dock. Once the buyer picks up the cargo, he assumes all other responsibilities, including transportation to the port of destination.

Ex Works is an Incoterm that is used for all forms of maritime transport, irrespective of the mode or stages of transport. Under this term, you as the buyer assume all the responsibilities of the shippers, once the cargo is packed in export packaging and collected. It means that you must arrange all transport, export documentation, cover all freight charges and carry out the import and delivery process. Once the goods are collected from the seller’s property, the risk is transferred to the buyer.

This type of transport leaves all risk and responsibility in the hands of the buyer, so novices and buyers unfamiliar with exporting are advised to use a freight and logistics company to avoid mistakes and unforeseen costs associated with shipping and transporting the goods.

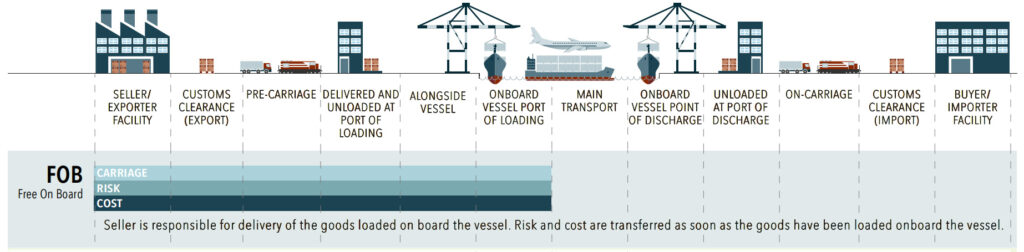

- Incoterms FOB

Free on Board, or FOB is an Incoterm, which means that the seller is responsible for loading the purchased goods onto the vessel, and for all associated costs. The moment the goods are safely on board the ship, the risk is transferred to the buyer, who assumes responsibility for the rest of the carriage.

FOB is the most common agreement between an international buyer and seller when shipping cargo by sea. This Incoterm only applies to shipments by sea and inland waterway.

Details to take into account for successful customs clearance.

After understanding the functionality of the incoterms and selecting the one that suits you best, the next step is to know the customs clearance procedure so that the synthetic rattan material you wish to import is not stranded in the port facilities of your country and that this fact generates additional costs for you.

Customs clearance is the process that allows the entry, transit and exit of goods from a customs office. In order to comply with the law, a series of documents must be presented to prove the import or export of the goods.

During the synthetic rattan import process it is important to know in detail the main functions of each document that must be presented.

- Preparation of the customs declaration, is a format made up of blocks in which importers, exporters or customs agents must only print the blocks corresponding to the information that must be declared, such as: quantity and type of merchandise, customs code, compliance with regulations and non-tariff restrictions, type of operation, customs regime, among other data and documents that must be attached to the aforementioned customs declaration.

- Tariff classification, it is easy to determine it through the customs code to know the amount to be paid for import duties on synthetic rattan.

- Payment of contributions, Contributions are determined according to the taxable base.

Synthetic rattan being a material made of high density polyethylene and plastic materials, does not require the presentation of a fumigation or disinfection document during the customs clearance process and is not classified as a hazardous material, which further facilitates the importation of this material.

FAQ

- The price offered by your company is subject to which incoterms?

The price per kg of synthetic rattan is subject to incoterms EXW.

- Can I go to the port myself and collect the goods from customs?

It is not advisable, it is best to hire the services of a company specialised in the import and customs clearance of goods.

- What is the best method of transport for an order of synthetic rattan?

Based on the characteristics of the packaging, the weight and the space taken up by the synthetic rattan, it is more economical and cost-effective to choose sea freight.

- Apart from the EXW YFOB incoterms, does your company offer any other incoterms if I decide to order?

Yes, in certain countries and at the customer’s request we can ship the material by DDP or door to door incoterms.

Conclusion

Incoterms define the responsibilities and rights of the parties to an export or import transaction. There are different types of Incoterms used for different trade practices. Depending on the nature of the transaction, the terms may vary, so it is important to know the relevant Incoterms before signing a contract.

The differences between Incoterms lie mainly in the rules and responsibilities relating to transport and customs clearance. Some Incoterms describe where the goods are shipped from, others describe when the goods are received by the buyer and whether the buyer is responsible for customs clearance. Some types of Incoterms are also used to determine what costs the seller or buyer must pay.

In most cases, Ex-Works Incoterms differ from Free Carrier Incoterms in that the buyer is more responsible for transport and customs clearance. With the Free Carrier Incoterms, the buyer can hire a freight forwarder or courier service himself. With the ex-works Incoterms, on the other hand, the buyer collects the goods directly from the seller and is responsible for all delivery costs incurred.